India Overhead and Gantry Crane Market Overview: Demand, Local Production, and Import Analysis

Table of Contents

The India overhead and gantry crane market size reached USD 180.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 320.63 Million by 2033, exhibiting a growth rate (CAGR) of 6.57% during 2025-2033. The market is expanding due to rising infrastructure projects, automation in manufacturing, and an increased demand from the steel, automotive, and logistics sectors. Key trends include smart cranes, IoT integration, and higher load capacities for improved efficiency and safety.

Demand for Overhead and Gantry Cranes in India

Under the government-led framework for large-scale infrastructure and industrial development, the demand for overhead and gantry cranes in India is driven by three main factors:

Infrastructure Construction

According to the Report of the Task Force on the National Infrastructure Pipeline (NIP) released by the Ministry of Finance, India is projected to invest approximately USD 4.51 trillion in infrastructure by 2030 to support its goal of becoming a USD 5 trillion economy by 2025.

With the launch and construction of large-scale projects such as roads, bridges, and industrial facilities, the demand for heavy equipment, steel structure installation, and large-scale lifting operations is rising significantly. Consequently, the continued advancement of national infrastructure investment is directly driving long-term growth in India’s market demand for various types of bridge and gantry cranes.

Port and Logistics

According to Sagarmanthan 2024, India’s Maritime Vision, India’s maritime sector handles about 95% of trade volume and 70% of trade value, with 12 major ports and over 200 small and medium ports. India plans to invest around USD 82 billion in port infrastructure by 2035.

As port throughput and facilities expand, demand for gantry and yard cranes in cargo handling and loading/unloading continues to grow, directly boosting the gantry crane market.

Steel Industry

Data from the Ministry of Steel indicate that India has become the worlds second-largest producer of crude steel, with output exceeding 150 million tonnes in FY 2023–24 and capacity utilization steadily improving.

With the expansion of heavy manufacturing and the steel industry, demand for bridge and gantry cranes in steel handling and heavy equipment operations is expected to continue rising, making them essential equipment supporting industrial development.

Local Manufacturing: Top 3 EOT Crane Manufacturers in India

India has a relatively mature EOT (Electric Overhead Travelling) crane manufacturing industry, with several local companies possessing long-term experience in design and production. These domestic manufacturers mainly serve sectors such as manufacturing, steel, construction, and infrastructure.

ElectroMech Material Handling Systems

Company Overview:

Founded in 1979, ElectroMech Material Handling Systems is one of India’s leading manufacturers and solution providers in the field of industrial cranes and material handling systems.

Main Products: EOT Cranes, Gantry Cranes, Jib Cranes and Customized Material Handling Systems.

Industries Served: Manufacturing and Engineering, Metals and Steel Production, Warehousing and Logistics and others.

Company Highlights:

- Over four decades of expertise in the crane and material handling industry

- Offers end-to-end solutions, from design and manufacturing to service and upgrades

- Recognized for engineering excellence, reliability, and customized solutions

Indef Manufacturing Limited

Company Overview:

Indef Manufacturing Limited, part of the Bajaj Group, is one of India’s leading manufacturers of material handling and lifting equipment. Headquartered in Navi Mumbai, Maharashtra, the company has been providing reliable and efficient lifting solutions to various industrial sectors since its establishment in 1962.

Main Products: EOT Crane, Gantry Crane, Jib Crane, Electric Chain Hoists, Lever Hoists and Crane Kits.

Industries Served: Metals, Oil and Gas, Engineering, Cement and Other Industrial Sectors.

Key Highlights:

- Over 60 years of industry experience with a strong reputation and trusted brand legacy.

- Comprehensive product range covering light to heavy-duty lifting applications.

- Backed by the Bajaj Group, offering robust R&D capabilities and manufacturing excellence.

Brady & Morris Engineering Co. Ltd. (India)

Company Overview:

Founded in 1946, Brady & Morris Engineering Co. Ltd. is one of India’s oldest material handling equipment manufacturers. The company is headquartered in Mumbai, with a major manufacturing facility located in Ahmedabad, Gujarat.

Main Products: Chain Hoists, EOT Cranes, Flameproof Cranes, Gantry Cranes, Jib Cranes and Customized Lifting Solutions.

Industries Served: Steel, Cement, Power, Mining, Chemicals, Defense and Textiles.

Key Highlights:

- A legacy company with nearly eight decades of experience in material handling solutions.

- Offers a comprehensive range of lifting equipment, from small-capacity manual hoists to large, heavy-duty cranes.

Import Trend Analysis: Overhead and Gantry Cranes in India

According to ITC Trade Map data, India’s imports of overhead cranes (HS842611) amounted to USD 17,373 thousand in 2024, with China being the largest supplier. Imports from China reached USD 12,641 thousand, accounting for 72.8% of total imports. Notably, India maintains a trade surplus in overhead cranes, indicating domestic production capacity, but still relies on imports for certain high-end or specialized models.

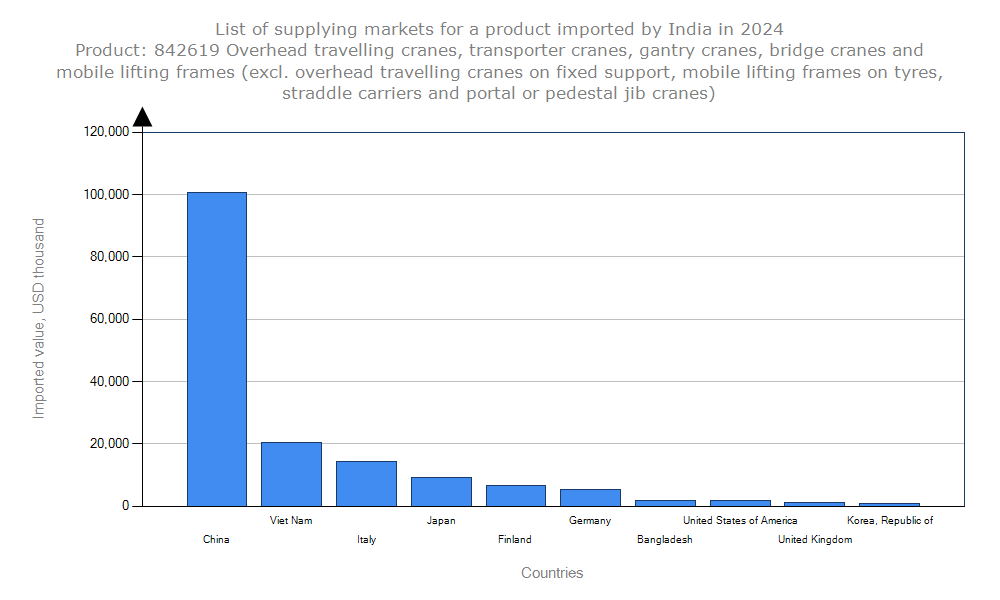

In contrast, India’s imports of gantry cranes (HS842619) reached USD 163,760 thousand in 2024, with China again being the main supplier. Imports from China amounted to USD 100,746 thousand, representing 61.5% of total imports. India runs a trade deficit in gantry cranes, highlighting that domestic production is insufficient to meet market demand, particularly for high-tonnage, industrially customized, or technologically advanced equipment.

Why China Is the Largest Source of Imports for India

India continues to import both gantry and overhead cranes from China, mainly due to several key advantages:

- Technical maturity: Chinese manufacturers offer a full range of cranes, including high-tonnage and customized models that Indian local producers often cannot match.

- Cost-effectiveness: Even after accounting for shipping costs, Chinese cranes generally provide better value, making them attractive for large-scale industrial projects.

- Reliable supply: Well-established production capacity and standardized modular designs enable consistent and timely delivery.

- International certifications: Chinese cranes comply with global standards, ensuring quality and safety.

- After-sales support: Support networks and service experience provide reliable maintenance and troubleshooting.

These factors make China the preferred source for many Indian enterprises seeking high-quality and ready-to-use crane solutions.

Why Choose DGCRANE as Your Partner

Given China’s position in supplying high-quality cranes to India, DGCRANE stands out as a trusted manufacturer in this field. With over 10 years of experience specializing in gantry and overhead cranes, DGCRANE has served clients in more than 120 countries, providing reliable, customized, and technologically advanced solutions.

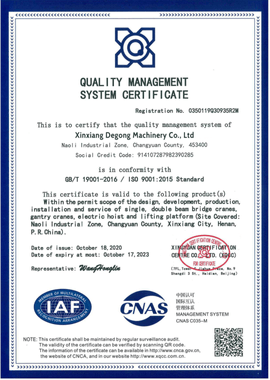

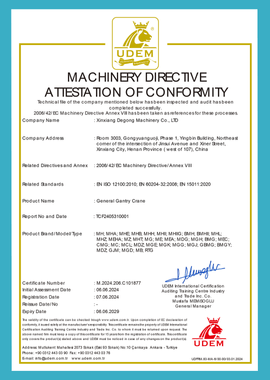

Certifications and Qualifications

High Quality Cranes at Competitive Prices

DGCRANE offers high-quality gantry and overhead cranes at cost-effective prices, providing excellent value for large-scale industrial projects without compromising on technology or reliability.

For example, the standard prices for single-girder eot cranes are as follows:

| Capacity (t) | Span (m) | Lifting Height (m) | Power Supply | Price (USD) |

| 1 | 10 | 6 | 380V, 50Hz, 3-phase | $1,850 |

| 3 | 14 | 10 | 380V, 50Hz, 3-phase | $2,430 |

| 5 | 9 | 9 | 380V, 50Hz, 3-phase | $2,310 |

| 5 | 16 | 13 | 380V, 50Hz, 3-phase | $3,350 |

| 10 | 13 | 16 | 380V, 50Hz, 3-phase | $4,100 |

| 16 | 20 | 22 | 380V, 50Hz, 3-phase | $7,300 |

Service

- Quick Response: A professional engineering team provides fast technical support and communication at every stage of the project.

- Customization: Cranes can be designed and built according to the plant layout, specific industry, working conditions, or special customer requirements.

- On-site Installation: DGCRANE offers on-site installation and commissioning services to ensure smooth and reliable operation.

DGCRANE Overhead Crane Exports to India

5 Ton LDC Overhead Crane and Steel Structures to India

DGCRANE supplied a 5-ton low-headroom overhead crane with supporting steel structures (columns, runway beams, and connection beams) to an Indian customer for a new workshop project.

Since the building had no existing crane supports, DGCRANE’s engineers designed a complete lifting system including the steel framework. To suit the limited workshop height, a low-headroom design was adopted for better space efficiency.

The crane was manufactured to 415V / 50Hz / 3Ph standards and delivered within 30 days. DGCRANE also provided on-site installation, commissioning, and worker training. The system was installed smoothly and the customer was very satisfied with the quality and service.

- Capacity: 5 tons

- Span: 10 m

- Lifting Height: 4 m

- Travel Length: 25 m

Five Sets of LH 10 Ton Double Girder Overhead Cranes to India

These five LH-type double girder overhead cranes were supplied to an Indian customer for handling iron products. Since the cranes are not operated frequently, the A3 work duty design was recommended, offering a reliable and economical solution for their application.

- Capacity: 10 tons

- Span: 24.425 m

- Lifting Height: 8 m

- Work Duty: A3

- Control Mode: Pendant control + Remote control

- Power Supply: 415V / 50Hz / 3Ph

5 Ton and 10 Ton Single Girder Overhead Cranes to India

Before confirming the order, DGCRANE shared workshop and production photos with the customer, who was impressed with the quality and quickly finalized the purchase within one month.The cranes are equipped with soft-start motors on the end carriages for smoother travel and longer service life.

Conclusion

India's overhead and gantry crane market is growing with infrastructure expansion and industrial development. Local manufacturers meet most standard needs, while imports—mainly from China—cover high-capacity and automated cranes. As modernization continues, both domestic and international suppliers will find steady opportunities in this evolving market.

Contact Details

DGCRANE is committed to providing the professional Overhead crane products and relavent service. Exported to Over 100 Countries, 5000+ Customers Choose Us, Worth to be Trusted.

Get In Touch

Fill out your details and someone from our sales team will get back to you within 24 hours!